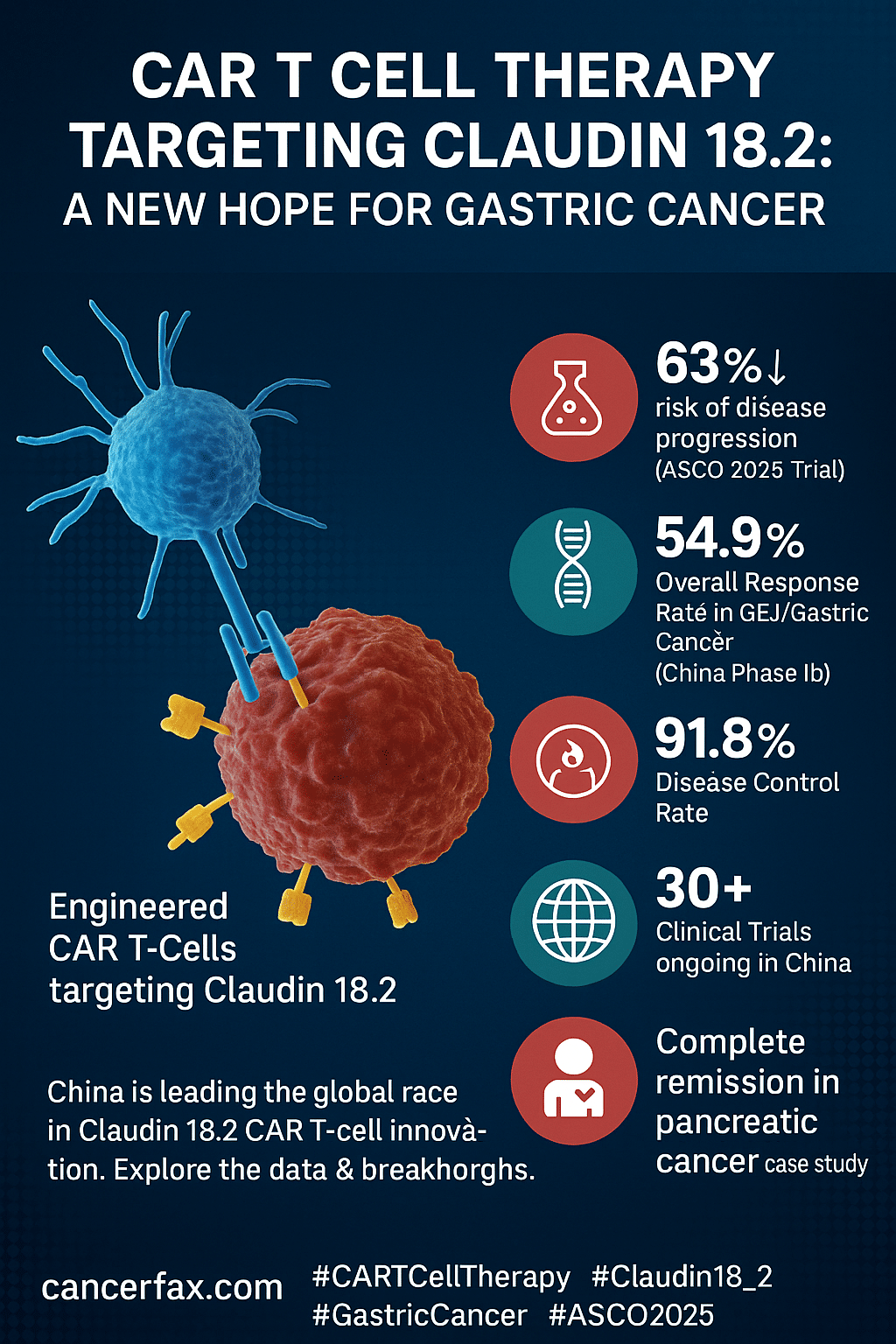

How China is leading the development of CAR T-Cell therapy?

March 2023: CAR-T-cell therapy is a novel and effective cancer treatment modality that has revolutionized the treatment of cancer, particularly blood cancers. This therapy achieves a therapeutic effect or cures disease by repairing or reconstructing genetic materials that have been damaged. Since Roseberg first isolated tumour-infiltrating lymphocytes (TILs) to treat melanoma in 1986, the development of modified T cell therapy has gained significant momentum.

Since the FDA approved the first CAR-T therapy, Kymriah, in 2017, the CAR-T market has grown rapidly. According to Frost & Sullivan, the global CAR-T market size is projected to increase from USD 10 million in 2017 to USD 1.08 billion in 2020, and then to USD 9.05 billion in 2025, with a compound annual growth rate (CAGR) of 55% from 2019 to 2025, making it the fastest-growing segment of the global cell and gene therapies (CGT) market.

CAR-T therapy is one of CGT therapy’s subsegments. On the basis of the origin of T cells, CAR-T therapy can be divided into two categories. Autologous CAR-T-cell therapy, which employs the patient’s own immune cells, and allogeneic CAR-T-cell therapy, which employs T cells from donor blood or occasionally umbilical cord blood,. The majority of CAR-T therapies are autologous CAR T-cell therapies, which typically involve the steps outlined below:

You may like to read: CAR T Cell therapy in China

1) T cells are harvested from the patient’s peripheral blood;

2) Viral vectors such as AAV then modify T cells with CAR genes that are directed against a specific cell-surface protein on cancer cells;

3) The modified CAR-T cells population is expanded according to the patient’s weight;

4) The expanded CAR-T cells are then reinfused back into the patient. The entire manufacturing procedure lasts between one and three weeks and requires GMP compliance in an ultra-clean environment.

CAR-T therapy has reached a level of success that has never been seen before in treating B-cell cancers that are resistant to or refractory to chemotherapy, including R/R, B-ALL, NHL, and MM. The effectiveness of treating solid tumours is also currently under investigation. CD19-targeting and BCMA-targeting CAR-T therapies achieve the greatest clinical success among all CAR-T therapies. Four of the six CAR-T therapies approved by the FDA target CD19, while two target BCMA.

The most significant advantage over small and large molecule drugs is that patients can replace lifelong treatment of chronic disease with a limited number of doses, or even just one.

The United States pioneered the development of the CAR-T industry. However, by the middle of the 2010s, China had learned quickly and was catching up to the United States. Principally, the key drivers can be attributed to the Chinese government’s support for the development of a CGT ecosystem comprised of biotech companies, academics, healthcare providers, investors, and the government.

Following the prioritization of biotechnology in the thirteenth five-year plan, the Chinese government emphasized its strategy to accelerate the innovation and development of biotech industries, including cell therapy. In addition, pertinent ministries have issued encouraging action regulations.

After the publication of Opinions of the State Council on Reform of the System of Evaluation, Review, and Approval of Drugs and Medical Devices in 2015, the capital market also became active. At a compound annual growth rate of 45%, Chinese cell-therapy companies raised approximately USD 2.4 billion in funding between 2018 and 2021.

You may like to read: CAR T Cell therapy cost in China

The number of CAR-T therapy trials in China surpassed those in the United States by 2018 as a result of this thriving ecosystem. As of June 2022, Chinese companies had conducted 342 clinical CAR-T trials. Malignancies in the B lineage were among the most prevalent manifestations. Two CAR-T products have commercial applications: Yescarta in June 2021 and Relma-cel in September 2021, among numerous drug candidates.

According to Frost & Sullivan, the domestic CAR-T market is projected to increase from CNY 0.2 billion in 2021 to CNY 8 billion in 2025, and then to CNY 28.9 billion in 2030, at a CAGR of 45% from 2022 to 2030. Despite the fact that the Chinese CAR-T market is still in its infancy, a robust driving force exists.

Although the two approved CAR-T products are from Sino-US joint ventures Fosun Kite and JW Terapeutics, domestic players have made breakthroughs and caught up to global players in recent years. Legend Biotech, IASO Biotherapeutics, and CARsgen Therapeutics all obtained NDA approval for their BCMA CAR-T products, establishing them as the leaders in BCMA CAR-T therapy.

CD19 CAR-T products are a focus for Juventas Therapeutics, Gracell Biotechnologies, Hrain Biotechnology, ImunoPharm, Shanghai Cell Therapy Group, and numerous domestic companies. Juventas Therapeutics is the leader in Chinese CD19 CAR-T therapy now that the NMPA has accepted its NDA for CNCT19. CARsgen Therapeutics is a global leader in solid tumours, and CT041 is the first CAR-T candidate for treating solid tumours to enter Phase II clinical trials. Bioheng Biotech and BRL Biotech (Chinese: ) create new allogeneic CAR-T markets.

You may like to read: CAR T Cell therapy for multiple myeloma in China

Dr. Nishant Mittal is a highly accomplished researcher with over 13 years of experience in the fields of cardiovascular biology and cancer research. His career is marked by significant contributions to stem cell biology, developmental biology, and innovative research techniques.

Research Highlights

Dr. Mittal's research has focused on several key areas:

1) Cardiovascular Development and Regeneration: He studied coronary vessel development and regeneration using zebrafish models1.

2) Cancer Biology: At Dartmouth College, he developed zebrafish models for studying tumor heterogeneity and clonal evolution in pancreatic cancer.

3) Developmental Biology: His doctoral work at Keio University involved identifying and characterizing medaka fish mutants with cardiovascular defects.

4) Stem Cell Research: He investigated the effects of folic acid on mouse embryonic stem cells and worked on cryopreservation techniques for hematopoietic stem cells.

Publications and Presentations

Dr. Mittal has authored several peer-reviewed publications in reputable journals such as Scientific Reports, Cardiovascular Research, and Disease Models & Mechanisms1. He has also presented his research at numerous international conferences, including the Stanford-Weill Cornell Cardiovascular Research Symposium and the Weinstein Cardiovascular Development Conference.

In summary, Dr. Nishant Mittal is a dedicated and accomplished researcher with a strong track record in cardiovascular and cancer biology, demonstrating expertise in various model systems and a commitment to advancing scientific knowledge through innovative research approaches.

- Comments Closed

- March 5th, 2023

BRL Biotech, CARsgen Therapeutics, China CAR T Cell, IASO Biotherapeutics, Juventas Therapeutics, Relma-cel

CancerFax is the most trusted online platform dedicated to connecting individuals facing advanced-stage cancer with groundbreaking cell therapies.

Send your medical reports and get a free analysis.

🌟 Join us in the fight against cancer! 🌟

Привет,

CancerFax — это самая надежная онлайн-платформа, призванная предоставить людям, столкнувшимся с раком на поздних стадиях, доступ к революционным клеточным методам лечения.

Отправьте свои медицинские заключения и получите бесплатный анализ.

🌟 Присоединяйтесь к нам в борьбе с раком! 🌟